Private equity of audit firms: A year on

A year ago, triggered by the majority stake acquisition of Grant Thornton’s US business by New Mountain Capital and others, we carried out research into how clients viewed the growing role that private equity ownership is playing in the audit and advisory industry. What does our follow-up research1 tell us?

What’s the same?

The overwhelming majority of audit clients continue to think that the involvement of private equity (PE) firms in the audit profession is a good thing. Twelve months ago, we thought that positivity might be a blip—but it’s not.

In principle, do you think that increasing private equity ownership would be a good or bad thing for the audit profession?

Clients remain intrigued by the potential of PE involvement to drive change in the industry, but are less likely to act on it: Last year, 93% of clients said that PE ownership would make them more likely to at least consider a firm, but this year that proportion has fallen to 78%. Meanwhile, the proportion who said it would make no difference or have a negative impact has risen from 8% in 2024 to 22% this year.

What’s changed?

But the reasons driving clients’ positive attitude to PE are different.

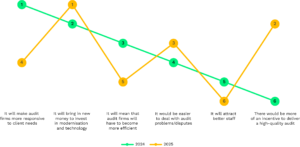

In 2024, the top-ranked reason why clients viewed the involvement of PE investment so favourably was that they thought new owners would shake up the audit industry, making it more responsive to clients’ changing needs. The extent to which these new owners would also be able fund investment in modernisation and technology was the second most important reason last year and is now the number one reason; in second place, and significantly higher in relative terms than last year, is that clients think that PE firms would have more of an incentive to deliver high-quality audits.

Why do you think increased private equity ownership would be a good thing for the audit profession?

Results are ranked in terms of relative importance

Data source: Audit Challenger survey 2024 and The Future of Audit survey 2025 [US and UK]

At first glance, this seems counterintuitive. PE firms have a reputation for putting profits first—and indeed, this is the main worry of the 7% of this year’s research who think that PE ownership is a bad thing. However, a lot here hangs on what is meant by audit quality.

In clients’ eyes, today’s external financial audit is a finely balanced trade-off between quality, speed, and price. It’s hard for quality not to be at the top of clients’ agenda: No one wants to be accused of cutting corners in an industry that’s had more than its fair share of scandals in the last five years. Forty percent of clients say that, should a major scandal engulf their current auditor, they would retender their audit. Clients are also almost four times more likely to change their auditor for quality reasons than because they’re forced to by mandatory firm rotation rules (27% to 7%). However, “quality” here may be less about regulatory compliance and more the content and scope of audit activity. Clients say that the most important way to increase the value of the audit would be around better use of data, as well as using technology to detect fraud at an earlier stage.

Which two of the following are most likely to add value to the audit process?

What’s the significance of this?

Last year, we argued that audit clients saw PE firms as a mechanism for modernisation. Clients had expected regulation intended to create more competition, to drive modernisation (it didn’t). They saw some evidence that technology was having an impact (but not as quickly or as comprehensively as they would have liked). Against this backdrop, PE firms were just the latest thing to pin their hopes on.

It feels as though that’s even truer today. Clients don’t just expect PE ownership to bring with it better customer service by injecting a new management style that makes firms more responsive to their needs. Rather, they’re even more focused on the idea of PE ownership bringing higher-quality audits through investment in modernisation and technology. And for clients, modernisation in audit means better use of data, increasingly in real time, and ultimately the ability to detect problems at an earlier stage.

PE firms that see an opportunity to buy audit firms to combine them, find synergies, and drive efficiencies are going to leave clients disappointed, and so may not achieve the returns expected. Clients expect PE firms to come with capital to invest in technology and AI, particularly around better use of data and detecting fraud earlier. This would deliver real value to clients and raise the quality of audits in their eyes. And if PE firms are able to invest in and transform mid-tier firms, the Big Four and other non-PE-owned audit firms will need to react and invest in themselves too.

1 We surveyed 270 senior buyers of external audit in June this year, drawn from a representative split of industries. 30% were based in the US, 30% in APAC; 22% were in Europe, and 19% in the UK. The sample was split equally between mid-sized companies (between 5,000 and 9,999 employees), large companies (10,000-19,999 employees, and very large companies (with 20,000 or more). See the Future of Audit 2025 available here The Future of Audit 2025 – Source

Audit firms need to invest in better use of data, technology, and in particular AI. But clients’ expectations may be different for Big Four firms, mid-tier firms, and PE-owned firms. Our latest leadership presentation on the Future of Audit looks at these issues and clients’ broader views about the future of audit, and explores how firms should react depending on their situation. Our presentation is delivered by our expects sharing their insights with you, and what this means for your firm.