Dependable innovation: How audit firms should embrace new technology

The future of audit will be driven by technology—but that doesn’t mean clients are looking for a revolutionary approach.Although the audit market is typified by clients sticking with their audit firm for many years, clients can and do change their auditors. And when they do, their decisions can have big consequences for firms.

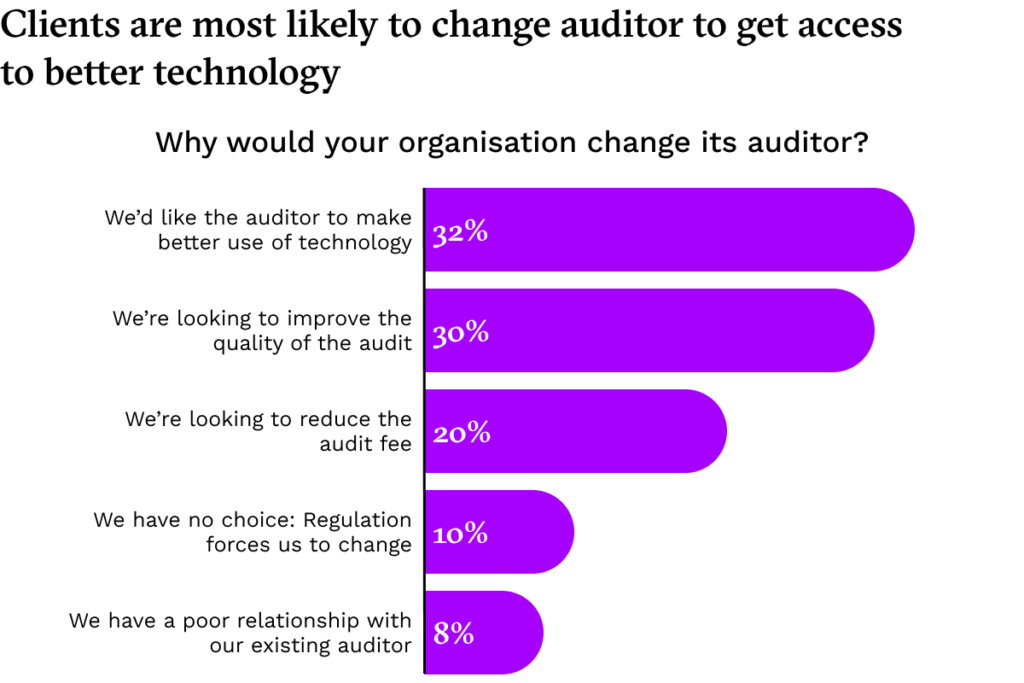

So why do clients switch? When we ask them, the growing importance of technology to the audit process stands out. A desire for their auditor to make better use of technology is the main reason clients cite for looking elsewhere, and technology plays a major role in both the second and third most important factors (improving the quality of audits and making them cheaper, respectively.)

Source: Perceptions of Audit Firms in 2022, available here

While clients tell us they’re unsure which particular technologies will be most important in improving the audit process, in the longer term they expect to see more AI, automation, and real–time data to help identify issues early, improve forecasting, and speed up the audit. Some clients clearly have in mind a vision of the future of audit, which moves away from an annual snapshot check of the accounts to a real-time analysis of financial data and identification of vulnerabilities before they even become an issue. In making this vision a reality, there exists the potential for huge disruption in the audit market, characterised by significant shifts in client behaviour—including who clients buy from.

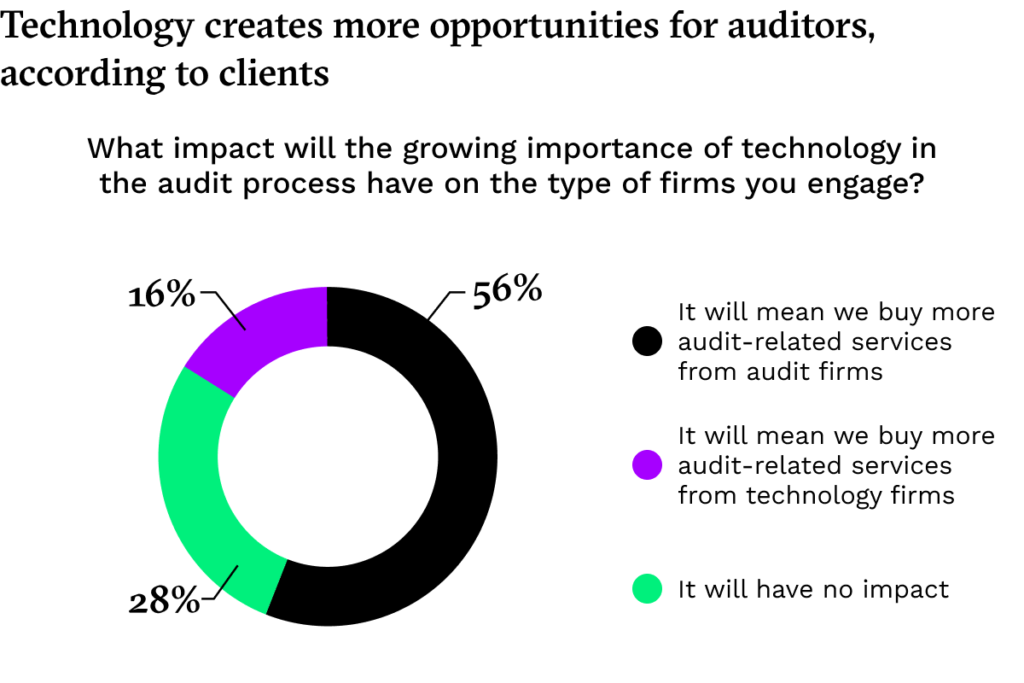

The good news for firms is that clients think technology actually creates more opportunities for auditors, rather than giving technology firms an opening to move in on audit firms’ territory.

Source: The Challenger Audit Brand: Can technology disrupt the audit market?, available here

In part, this may be because the pandemic forced audit firms to innovate, and, in doing so, they demonstrated better than expected adaptation to new technology. However, even though many clients are prepared to break up the audit process and look outside traditional audit firms for the delivery of different parts (indeed 20% of audit clients we surveyed said they were already doing this, with a further 33% saying they were actively thinking about it), there are barriers to clients using technology firms, software vendors, or other providers for aspects of the audit.

Aside from regulatory constraints, which mean clients can only use non-audit firms for specific aspects of the audit process, many other firms either don’t offer audit-related services or are conflicted out as clients are working with them already in an advisory capacity. Those firms not conflicted out probably don’t have enough brand recognition at the board level to provide audit services, making it tricky for any start-ups or niche providers to break into this space. Cybersecurity concerns and worries that an auditor’s technology may not integrate neatly with their own systems also make clients hesitant about new technology changing up the audit process.

Between two worlds

This hesitancy points to a major additional challenge audit firms face: the conflicting images they need to project to clients.

On the one hand, firms clearly need to innovate and incorporate new technology into the audit. Slow movers risk shedding clients, and, from a branding perspective, firms need to be associated with strong technology capabilities.

But, at the same time, audit firms need to retain the kind of reputation for honesty and dependability that can only be built up over decades. They can’t risk suggesting they would be cavalier with cybersecurity and data protection issues, or create additional challenges for clients with a high-tech audit. Unlike on some consulting projects, audit clients are unlikely to want to feel like they’re the guinea pigs for new, untried technological solutions, which may give them access to a better solution than their competitors, but will undoubtedly involve some hiccups along the way.

This is a difficult bridge to cross, given that cutting-edge technological innovation by its nature is not yet perfect or refined, and increased digitisation could result in increased vulnerability to cyber-attack. The key is to show “safe” technological advancement, improving the service for clients without exposing them to new cyber threats and technological challenges, and to promote constant relentless evolution, rather than revolution.

In short, firms need to show dependable innovation. While this might not mean a sudden step-change in how audits are done, a continuous slow burn of technological progress could still mean the audits of the 2030s look very different from today.

Martin White is a principal consultant in our Client and Brand Insights team; he works with professional services firms to help them understand how they are perceived in the market across multiple lines of business, including consulting, risk advisory, tax advisory, and audit